|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

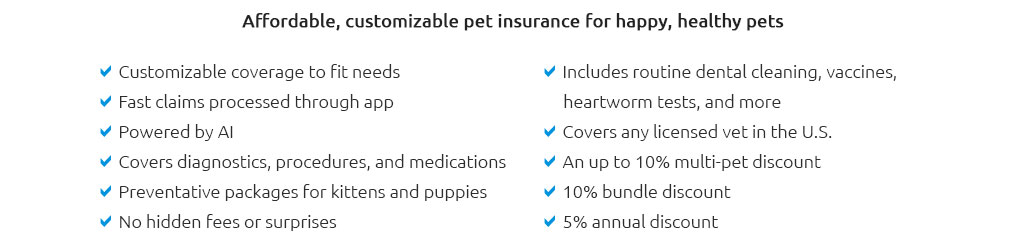

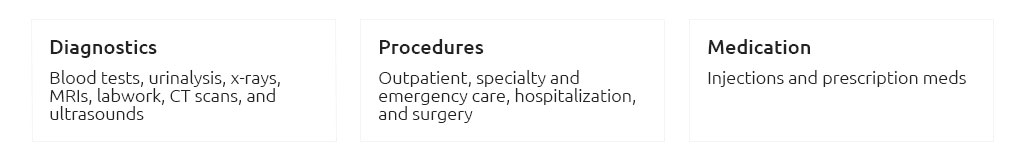

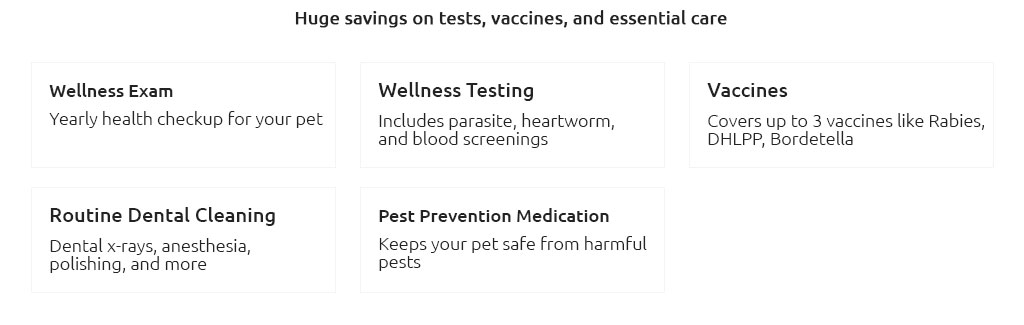

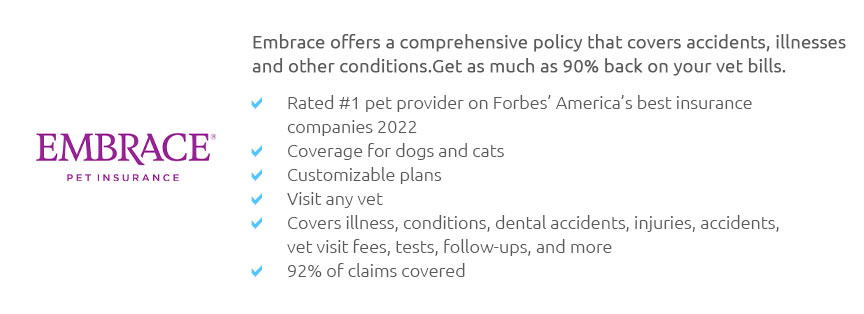

Understanding the Intricacies of Pet Vet InsurancePet vet insurance, an increasingly popular option among pet owners, offers a safety net for those unexpected veterinary expenses that inevitably arise when sharing your life with a furry companion. In a world where pets have become integral members of the family, ensuring their health and well-being is paramount. This is where pet insurance comes into play, providing not only peace of mind but also a financial buffer against potentially exorbitant medical costs. At its core, pet vet insurance functions much like human health insurance. Policyholders pay a monthly or annual premium, and in return, the insurance company covers a portion of the veterinary expenses incurred. However, unlike human health insurance, pet insurance policies typically operate on a reimbursement basis, requiring pet owners to pay the vet bill upfront and then submit a claim to the insurance provider for reimbursement. This can sometimes pose a challenge for those who may not have the funds readily available, but the eventual reimbursement often alleviates the financial strain. The nuances of pet insurance policies can vary significantly between providers, making it essential for pet owners to thoroughly research and compare options. Coverage can range from basic accident-only policies to comprehensive plans that include routine care, dental procedures, and even alternative therapies such as acupuncture. Some plans also offer additional perks like coverage for behavioral issues or end-of-life expenses. Pet owners should carefully consider their pet's specific needs, age, breed, and pre-existing conditions when selecting a policy, as these factors can significantly influence both the cost and the coverage limits. One of the more subtle advantages of pet insurance is the freedom it affords pet owners when making medical decisions for their pets. Without the constraints of financial limitations, pet owners can prioritize their pet's health and opt for the best possible treatment rather than the most affordable one. This can lead to better health outcomes and a higher quality of life for pets, which, for many, is invaluable. However, it's important to note that not all pet insurance policies are created equal. Premiums can vary widely based on factors such as the pet's age, breed, and location, as well as the chosen deductible and reimbursement level. Moreover, some policies have caps on the amount they will pay out annually or per incident, which can impact the overall value of the coverage. Pet owners are advised to read the fine print carefully and ask pertinent questions to ensure they fully understand the terms and conditions of their policy. In conclusion, while pet vet insurance may not be necessary for every pet owner, it certainly provides an additional layer of security for those who want to ensure their pet's health is never compromised due to financial constraints. With a variety of plans available, pet owners have the flexibility to choose a policy that aligns with their budget and their pet's healthcare needs. Ultimately, the decision to invest in pet insurance is a personal one, but for many, the peace of mind it offers is well worth the investment. https://www.costco.com/pet-insurance.html

Pet medical insurance can help reduce financial stress when choosing care for your dog or cat. For a monthly premium based on your pet's age, breed, location ... https://www.aspca.org/about-us/strategic-cause-partnerships/aspca-pet-health-insurance

Cat Insurance. Cat coverage is intended to help you ensure they can have access to the best veterinary care possible with less worry about the costs. Read ... https://www.petco.com/shop/en/petcostore/insurance

Our most popular coverage starts at around $90/month for two dogs, which includes a 5% multi-pet discount. Two cats on our most popular plan would cost about ...

|